Motor Insurance

Motor insurance is a mandatory vehicle insurance policy for vehicles like trucks, cars, jeeps, bikes, scooters, etc. With Motor Insurance, get comprehensive coverage against accidental damages and Third-party liabilities. Apart from that, it is also helpful at the time of natural calamity, theft, fire damage, vandalism, man-made disasters, etc. There are mainly three types of Motor Insurance covers available in India: third-party insurance cover, standalone damage cover, and comprehensive insurance cover. Here is a comprehensive guide explaining motor insurance, its meaning, types, and benefits.

- Details

- By Dhwani

- Category: Motor Insurance

- Hits: 105

According to ETBFSC, almost 95% of motor insurance claims in India are for own-damage, mostly from minor accidents, collisions, or bumps, showing how common everyday accident claims are. A car accident can be a stressful experience. Apart from the shock and damage to your vehicle, you also have to deal with insurance formalities and paperwork.

- Details

- By Dhwani

- Category: Motor Insurance

- Hits: 113

Purchasing car insurance is not only restricted to choosing the cheapest—it’s about getting maximum coverage at the right price. With multiple insurers, add-ons, and discounts available online, comparing and choosing wisely can help you save thousands every year.

- Details

- By Dhwani

- Category: Motor Insurance

- Hits: 330

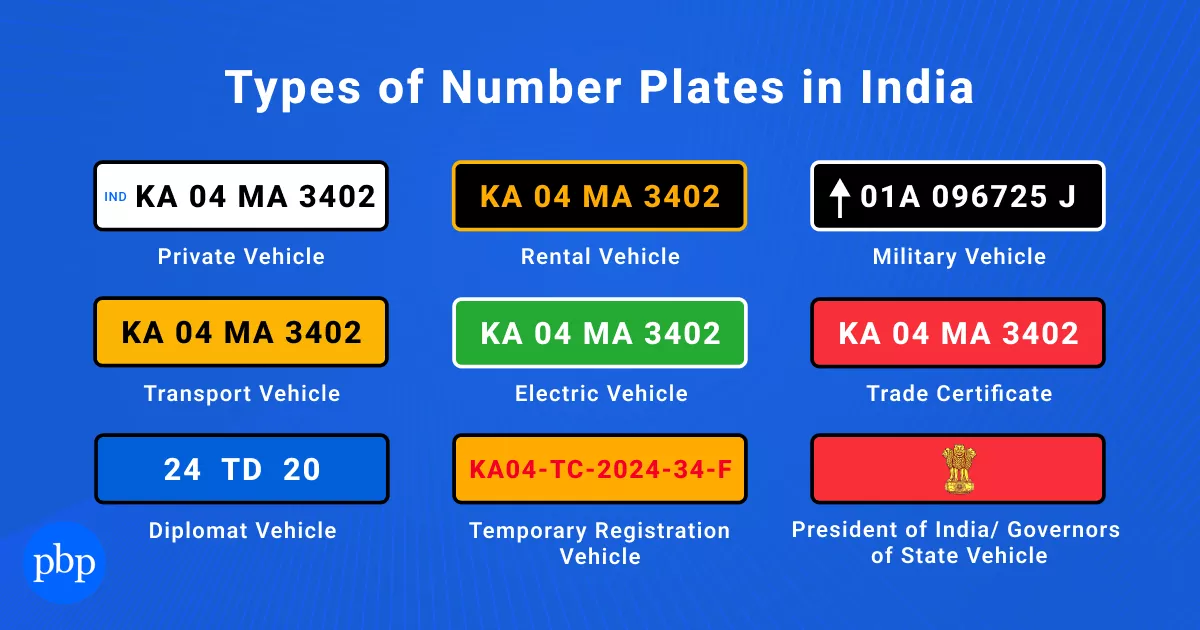

There are different types of number plates; each colour number plate has a unique alphanumeric code that links the vehicle to its state, RTO, and owner, making it easy for authorities to track vehicles, enforce road safety rules, and ensure accountability. Driving without a valid plate is a punishable offence in India.

- Details

- By Dhwani

- Category: Motor Insurance

- Hits: 93

Maintaining transparency with your motor insurer is the most effective way to ensure your financial safety. While some motorists might feel tempted to misrepresent facts to lower their premiums, the long-term consequences of such actions are severe. Car insurance is a legal contract based on the principle of "Utmost Good Faith," meaning both you and the insurer must be completely honest with each other.

- Details

- By Dhwani

- Category: Motor Insurance

- Hits: 600

When we talk about car safety, we often think of seat belts, airbags, and brakes. But one crucial safety feature that drivers use every single day often goes unnoticed: the ORVM. While often simply called "side mirrors," these components have evolved into sophisticated safety devices. What many car owners don’t realise is that ORVM damage is closely linked to car insurance coverage, and understanding this connection can help you save money and avoid claim confusion.

- Details

- By Dhwani

- Category: Motor Insurance

- Hits: 435

A stolen car is not just a financial setback. Daily routines take a hit. School drops need rearranging. Office commutes become longer. Even simple hospital visits need planning again. Along with this comes the stress of police visits, insurance paperwork, and not knowing how long it will all take.

More Articles …

- Grace Period in Car Insurance Renewal: Why It Matters & What Happens If You Miss It

- Best Car Insurance Add-Ons in 2026: Coverage, Benefits & When to Choose Them

- RTO Charges for New Cars in India (State-Wise): Don’t Buy Before Checking These Rates

- New Vehicle Registration Process in India: Step-by-Step Guide for Car & Bike Owners

Page 1 of 10